Many have written about whether the Employers must continue to pay salary during the MCO period. In a press report carried on 23.3.2020, the Human Resources Ministry issued a statement (on the FAQ issued by the National Security Council) that all employers are NOT allowed to cut the salary of employees or force them to take annual leave. All salaries must be paid during the MCO period.

The MCO is unprecedented and this article is not intended to discuss the legality on the statement issued by the Ministry of Human Resources except to mention that it remains a guideline and does not have the force of law. Questions of law will be determined by the courts after full arguments be ventilated in future and the effects of Covid-19 on employment law remain to be seen.

This article is intended to however list down the options an EMPLOYER have to reduce staff cost in simple terms.

Actual terms of the contract of employment

Note that the key decisive factor is always dependent on the actual terms and conditions contained in a contract of employment. If they are clearly set out in the contract of employment, they will take precedence over general application of law and the below may not be relevant.

A. UNPAID LEAVE?

Employee voluntarily takes unpaid leave

During the MCO period, an employer can offer an option to the employees to take unpaid leave. If the employee wishes to do so on his/her on accord, the leave will be taken on a non-paid basis and the employer does not need to pay salary during the MCO period.

Employee does not take up unpaid leave and work from home

If the employee does not wish to take up unpaid leave and continue to work from home, an employer must pay salary as usual since the employee is still carrying out his/her duties.

Employee who does not take up unpaid leave and cannot discharge duties from home

An employee who does not wish to take up unpaid leave and cannot discharge his/her duties from home (like waiting staff at retail outlets, personal driver, cashier) may not be as clear cut. One may argue that the MCO is an event of force majeure (unforeseeable events which render the contract frustrated) and that an Employer does not need to pay salary. Having said that, the MCO period however is only for a period of 2 weeks (or its extended period will remain a short one) and may not be taken as an event frustrating the contract of employment. In that regard, the contract of employment is at best suspended but salary must still be paid.

Employer cannot force the employee to take unpaid leave

In short, the Employer cannot force the employee to take unpaid leave and should still pay the Employee during the MCO period.

B. CUTTING SALARY?

A reduction in salary is a variation to the contract of employment. A reduction is possible if the employee consents to it.

Failure to obtain consent amounts to a breach of the contract and the employee may claim constructive dismissal.

A reduction in salary must be done bona fide. They can be done if there is a valid reason (eg: a demotion or poor economic conditions) as an alternative to retrenchment. If the reduction of salary is solely dependent on the MCO, that is not a good reason. Should Covid-19’s effect is prolonged for a reasonable long period which results in business suffering from long term losses or a downturn, then a reduction in salary maybe a plausible option.

In short, the reduction in salary must be done with care and in good faith with justifiable cause.

C. RETRENCHMENT?

A retrenchment happens when there is a redundancy. Redundancy means there is surplus of workers and the job function is no longer required.

Valid reasons for retrenchment can be due to:

(a) outsource of job scope

(b) cut losses;

(c) minimise impact of poor economic conditions

The key thing for the Employer to prove is that the employee’s functions were reduced making them redundant.

In deciding whether a retrenchment is bona fide, the Court may look into several factors depending on the facts of each case. Some of them are:

(a) whether there are any other alternatives steps taken to reduce cost;

(b) whether there is sufficient notice given;

(c) whether the employee can be transferred to another department

Retrenchment based on MCO

Since the MCO only runs within a 14 day period, if an Employer wishes to introduce retrenchment solely based on the MCO period, that may fall short of the standards.

Should the Covid-19’s effects continuously be felt through several quarters down the line, this may be an option to explore.

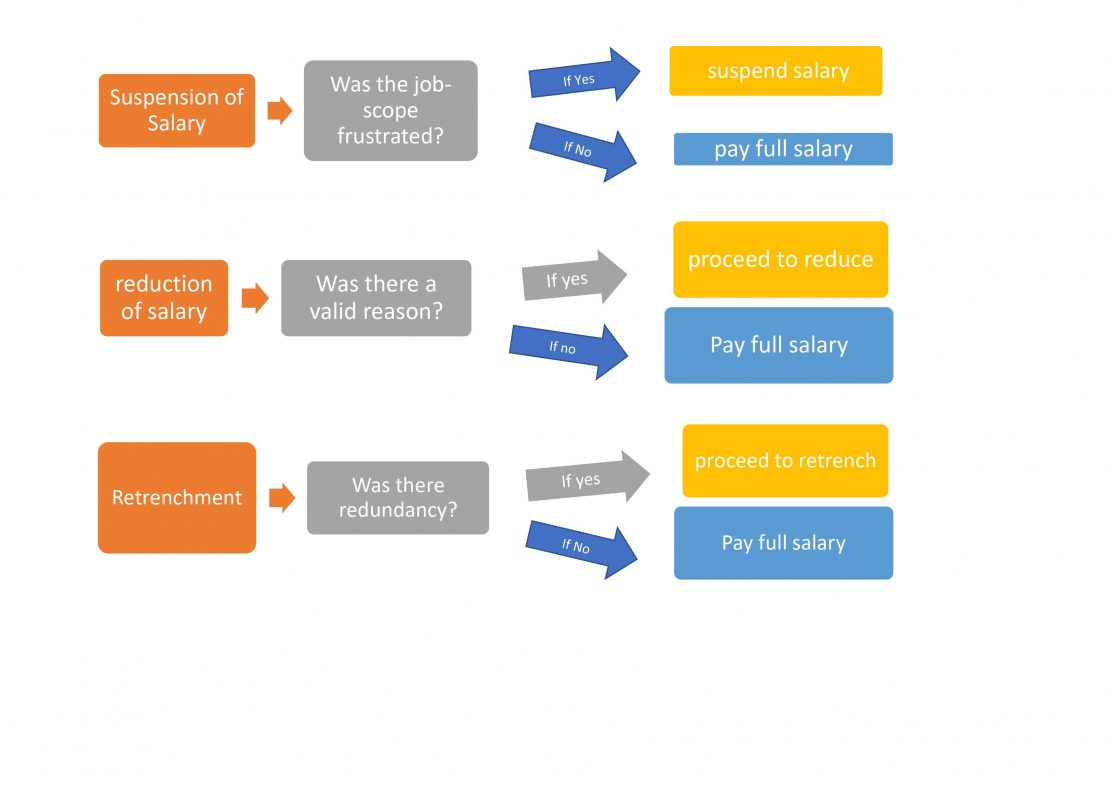

A chart is prepared for quick reference below:

Conclusion

Each option above has their respective test to be fulfilled and they must be done with care. Ultimately, the welfare of the employee must be protected and exercises above should not be abused. If they were not implemented in accordance to the law, a claim of unlawful dismissal may be lodged against the Employer and the exposure of damages are substantial. That will defeat the purpose of making a saving for the Employer.

This article is written by Lee Yoke Shan, an Associate of Messrs Chee Hoe & Associates, Advocates & Solicitors, a legal firm in Kuala Lumpur, Malaysia. She practices in the area of employment law and handle industrial relations disputes. You can contact her if you have a question.