GST In The Sub-Sale Market

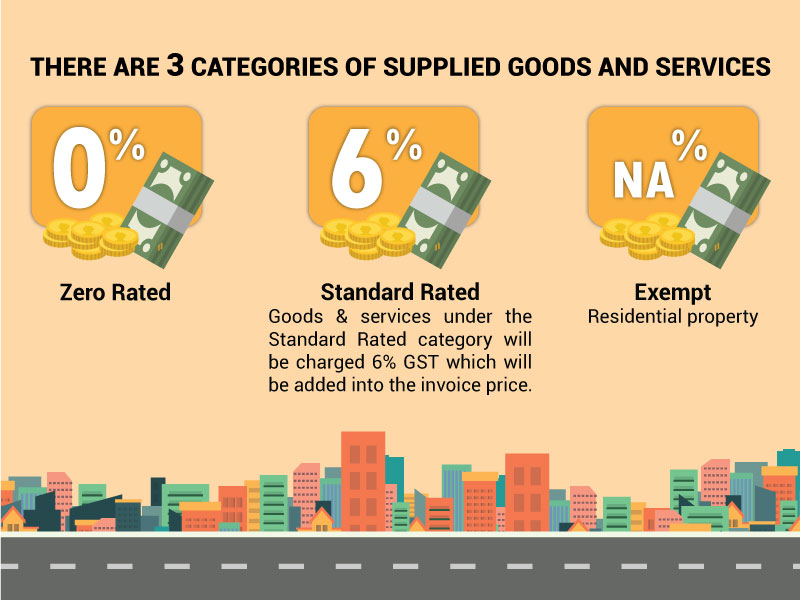

GST (Goods & Services Tax) is a tax on sales & services, therefore a tax on all kinds of consumption. It was implemented and put into effect on 1 April 2015 as a replacement for the then widely used Sales & Service tax. Presently, the general rate of GST in Malaysia is 6% compared to the SST which was 5%-15%. However, there are certain goods and services that are exempt from GST.

On a related note, the Malaysian Bar Council website has a FAQ for conveyancing transactions here. Below is a flowchart indicating what is taxable under the GST.

Information verified by Chee Hoe & Associates.